A crypto trading hamster is beating the S&P 500 and Warren Buffet: what in the world?

This article was originally written 9/28/2021. Last updated 4/19/2022 to reflect that Mr. Goxx has sadly passed away.

Recently, social media has been buzzing with the news that a crypto trading hamster, cleverly named Mr. Goxx (likely in homage to Mt. Gox, an infamous Bitcoin exchange during the early days of Bitcoin), is outperforming the S&P 500 as well as famous investors like Warren Buffet. The hamster’s shenanigans are live-streamed on twitch.tv and he has his own twitter account, @mrgoxx. He even has his own subreddit, r/mrgoxx, where the hamster’s daily trades are posted for the world to see. His exploits have now reached mainstream media outlets, such as NPR and Yahoo.

How does a hamster trade crypto?

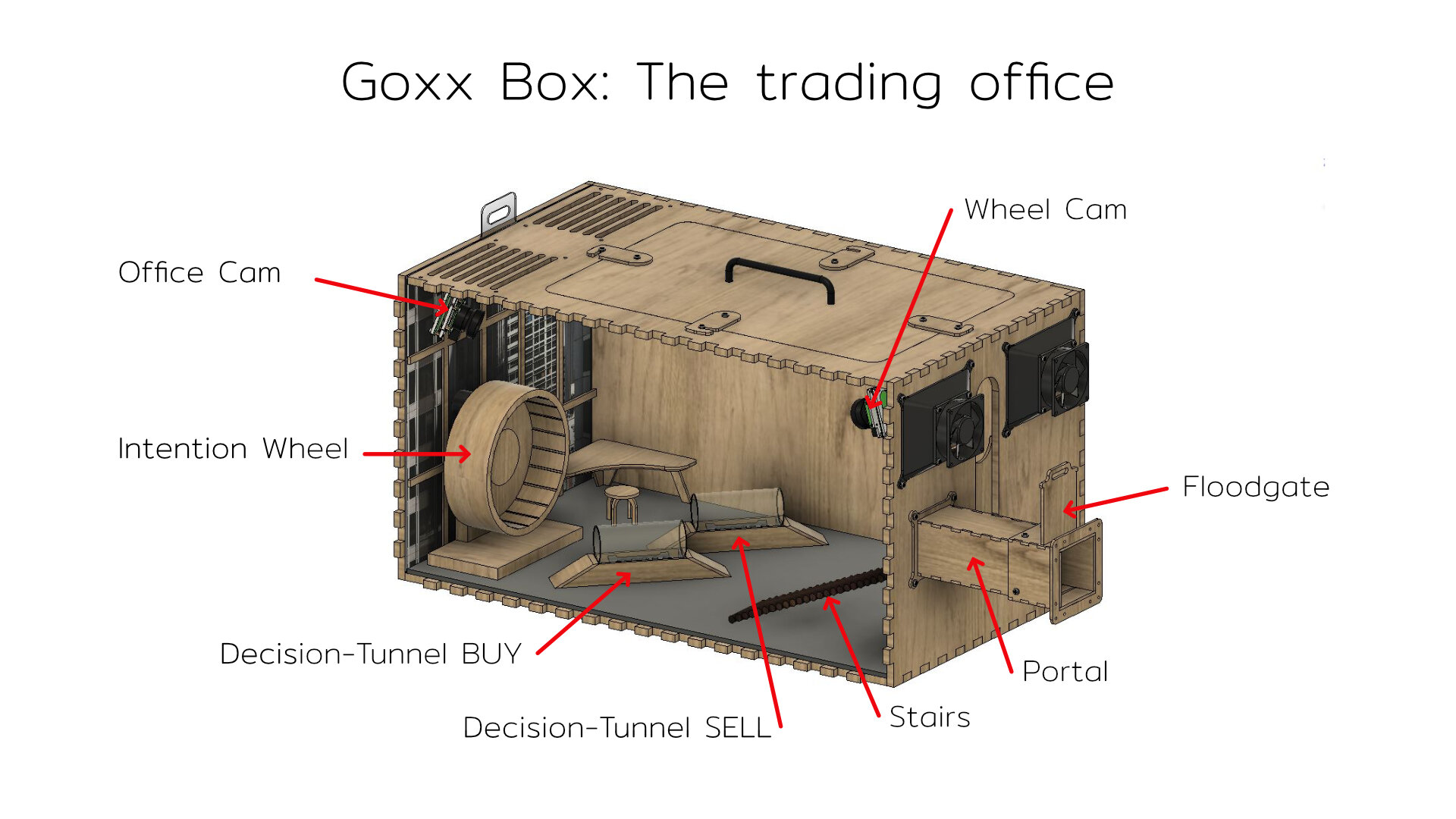

Image from @mrgoxx on twitter.

The setup is pretty simple. The hamster enters a custom-built cage that has a wheel that is wired to about 30 different cryptocurrencies. After selecting a random crypto on the wheel, the hamster can then enter one of two tunnels - one to buy said cryptocurrency, and one to sell it. The hamster’s decision is sent to a real crypto exchange, and real money (albeit a small amount) is involved.

Here’s a video clip, from Mr. Goxx’s YouTube channel, of the hamster’s setup and activities:

How is Mr. Goxx performing?

Mr. Goxx started trading on June 12, 2021. The initial account was funded with 326 Euros (approximately $390 at the time). As of September 27, 2021, Mr. Goxx’s portfolio is sitting at 389.27 Euros, representing +19.41% gains in about 100 days of trading. That’s superb!

Many news sites were quick to point out that during this time, Mr. Goxx outperformed many popular benchmarks. For example, the S&P 500 returned about +4.8% during this same time period, and Warren Buffet’s company, Berkshire Hathaway, is actually down about -3.2%.

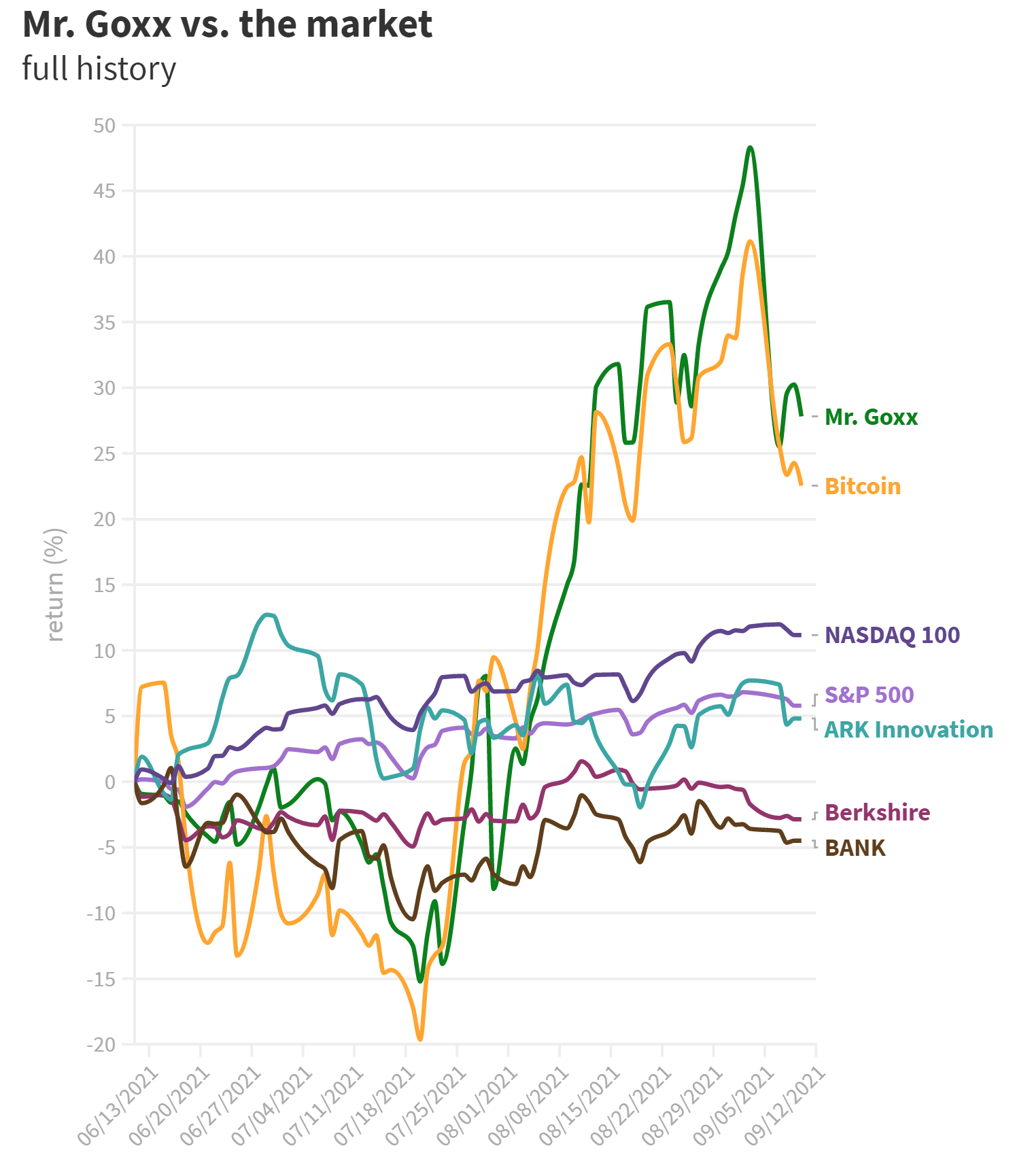

Protos.com, a site devoted to cryptocurrency journalism, was one of the first places to report on Mr. Goxx. In their latest update, they show a handy chart of Mr. Goxx’s performance against other selected assets:

Image from Protos.com article. (Note that this chart only shows performance up to 9/10/21).

While this story is cute, amusing, and being widely shared across the internet, literally no one is rushing to copy this highly successful strategy of using a hamster for trading decisions. This is akin to those animals that can “predict” the winner of the Super Bowl or World Cup. No one actually believes that Mr. Goxx has any actual trading skills or is somehow clairvoyant. Obviously, Mr. Goxx’s methods are random, and his results are from luck.

Nonetheless, I think we can all learn a few things here. My biggest take-aways are the following:

Different asset classes perform differently

Comparing any crypto trader’s performance to the S&P 500 is silly. Cryptocurrencies, as an asset class, are highly volatile, and have different performance characteristics and risk profiles than stocks. During Mr. Goxx’s trading tenure so far, most of the popular cryptocurrencies beat the S&P 500. His results are only meaningful when compared to other crypto traders. Comparing crypto trading results to the S&P 500 is about as meaningful as comparing a stock trader’s results to bond returns.

As previously mentioned, from start of trading on June 12 to now (September 27), Mr. Goxx’s portfolio is up +19%, which handily beats the S&P 500 during the same time period. Within the context of the crypto market, however, if we look at the three largest cryptocurrencies by market cap (all three are included in Mr. Goxx’s hamster wheel), his performance becomes quite pedestrian. Bitcoin (BTC) is up +21% during this time. Ethereum (ETH) is up 29%. Cardano (ADA) is up a whopping 50%.

In fact, if you look at Proto.com’s graph of Mr. Goxx’s performance, you’ll see that his portfolio tracks very closely with Bitcoin, and Bitcoin is a proxy for the broader crypto market. Over a 100 day span, Mr. Goxx’s performance does not deviate much from Bitcoin, and therefore the overall cryptocurrency market as a whole. As of September 10, he was slightly outperforming Bitcoin, but as of today, he is not.

Trading is a zero-sum game

Buying and holding of a productive asset is the fundamental principle of sensible, long-term investing. On the other hand, trading of assets is a zero-sum game. This is true regardless of the asset class, whether it is stocks or cryptocurrencies. With every trade, one person comes out the winner, and the other is the loser. Yes, you can beat the market average through active trading. In fact, exactly half of active traders do beat the market. The other half do not. The result is that in aggregate, active trading produces exactly the same average returns as the market itself. Finally, trading incurs more fees than passive investing, and when fees are taken into account, trading becomes a negative-sum game.

Small sample sizes are meaningless

A single hamster making decent trades over the course of 100 days is rather meaningless in the grand scheme of things. Mr. Goxx’s portfolio might crash and burn in the next 100 days, or he may get lucky and hit a jackpot. As time goes on, however, I think any outlandish results will experience regression to the mean.

The only way to be sure whether hamsters are in fact superior traders is to run an experiment with millions of hamsters trading over the course of years, and see if those results differ from trades made purely at random. I think you already know the answer.

Conclusion

Even Mr. Goxx’s owner states that “The stream and all related posts are for entertainment purposes only”. Maybe that’s just for liability reasons, but I’m pretty confident that the man running the show knows that hamsters are not legitimate crypto traders.

I hope you enjoyed this fun little distraction. All jokes aside, check out my Investing 101 series for sensible investing advice. As always, thanks for reading and happy investing!

Final update

Sadly, on November 24, 2021, shortly after he went viral, Mr. Goxx’s owner tweeted that the hamster passed away.

During his short but illustrious career, Mr. Goxx traded from June 12, 2022 to November 22, 2022, and his portfolio was up 19.7%.

During this same period of time, the S&P 500 gained 10.3% (using June 11’s closing value, as June 12 was a Saturday), and Bitcoin gained 47.24%. So while Mr. Goxx did not outperform Bitcoin, he did outperform the S&P 500 for his entire career.

Shortly after his death, the price of Bitcoin and other major cryptocurrencies began a downward decline, and as of early 2022, have yet to regain their November 2021 highs.

Mr. Goxx’s ultimate legacy, of course, is not his trading performance. As his owner stated, “Mr. Goxx has brought joy to people all across the globe and reminded us not to take life too seriously. He shed light into dark moments of pandemic, inflation and many kinds of trouble.” Rest in peace.