I tried mining another cryptocurrency, ADA, on the Cardano network.

Updated on 9/1/21.

Recently, I wrote an article describing my attempt to mine Ethereum with my home computer. I was pleased with the results, but more than anything else, it lead me down a rabbit hole of researching various cryptocurrencies, an asset class which I previously ignored completely. It wasn’t long before I tried a second method of cryptocurrency mining.

As I mentioned in that article, every cryptocurrency network uses blockchain technology hosted in a de-centralized manner on a peer-to-peer network. The blockchain itself is a permanent ledger of transactions on the network, and every transaction is validated by a consensus of network peers. No central authority is in control of the network, and no malicious actors can easily alter the blockchain (in theory), as the resources required would outweigh any benefit.

In return for running the network and validating transactions, the network participants are rewarded with the network’s cryptocurrency. The two largest cryptocurrencies today by market cap, Bitcoin and Ethereum, both operate under a Proof of Work, or PoW method, where raw computing power is used to “solve puzzles” and validate network transactions. However, since the original introduction of Bitcoin, blockchain technology has been further refined and improved. Now, there are several alternative blockchain algorithms which have been developed, such as Proof of Stake and Proof of Space/Storage. Despite this, the vast majority of cryptocurrencies today still operate under the Proof of Work method.

Proof of Work is controversial

Increasingly, however, Proof of Work cryptocurrencies have come under criticism for their environmental impact and carbon footprint. A recent study estimates that the carbon emissions from Bitcoin mining in China alone will soon exceed the entire carbon emissions of many European countries. And the University of Cambridge’s Bitcoin Electricity Consumption Index estimates that as of June 2021, the Bitcoin network consumes well over 120 Terawatt-hours (TWh) of electricity per year (as of July 1st, this is down to about 60 TWh; likely temporarily, as China has shut off electricity to Bitcoin miners). This is roughly equivalent to the entire electricity consumption of countries such as Norway and Argentina at around 125 TWh/year. The total global electricity consumption of Bitcoin is estimated to be around 23,500 TWh/year. This means that the Bitcoin network alone accounts for approximately 0.5% of the world’s electricity usage.

This has not gone unnoticed by prominent scientists, politicians, and businessmen. For example, Elon Musk is famously pro-cryptocurrency, and in early 2021, Tesla bought $1.5 billion worth of Bitcoin and announced it would accept Bitcoin as payment for Tesla cars. Shortly afterwards, taking advantage of Bitcoin’s price increase, Tesla sold some of its Bitcoin, making over $100 million in Q1 2021 profits from Bitcoin, more than it had from actually selling cars. This move was heavily criticized from both a business and an environmental standpoint. Shortly thereafter, on May 12 and May 13, 2021, Elon Musk abruptly reversed course and tweeted:

Over the next few days, the market price for Bitcoin, Ethereum, and most other Proof of Work coins crashed. On the other hand, the market price of Proof of Stake coins, such as ADA, soared:

Bitcoin vs. ADA price change between May 12, 2021 to May 14, 2021.

More recently, Chinese authorities have cracked down on Bitcoin, ordering Bitcoin miners to stop and shutting off electricity to Bitcoin farms. It should be noted, however, that China’s stance against Bitcoin is probably not due to environmental concerns alone, but rather due to it’s decentralized nature which the central government cannot control. Many Bitcoin miners are in the process of taking their equipment to mine elsewhere.

ADA and Proof of Stake

ADA is the name of the cryptocurrency on the Cardano network. The Cardano network uses a method known as “Proof of Stake” instead of the traditional Proof of Work used by many cryptocurrencies. Cardano is not the only Proof of Stake cryptocurrency out there, but it is currently the largest one by market cap. It is also the 4th largest cryptocurrency by market cap overall, behind only Bitcoin, Ethereum, and Tether (and sometimes Binance coin, depending on price fluctuations).

The main difference between Proof of Stake and Proof of Work is that in PoS, a network participant can validate blockchain transactions based on the number of coins they already have. Therefore, instead of requiring sheer computational power in order to participate in a Proof of Work network, a Proof of Stake network requires putting up some coins as a “stake” in order to participate.

In fact, Proof of Stake cryptocurrencies were developed specifically as an alternative to Proof of Work cryptocurrencies, because PoW can be so wasteful in terms of electricity and computational power. PoS networks use very little power in comparison - a distributed network of peer to peer computers would still have to run the network nodes, but actual transactions on the network do not require wasteful power expenditure to validate. The Cardano network is estimated to use 6 GWh of electricity annually, which is about 20,000x less power than the Bitcoin network.

In layman’s terms, in order to “mine” a Proof of Stake coin such as ADA/Cardano, you simply need to own some ADA coins and put it up as a “stake”. Your mining “yield” comes not from how powerful your hardware is, but rather how many coins you own, in proportion to all of the staked coins out there. Therefore, staking ADA generates more ADA passively, similar to getting paid interest on your money at a bank.

Mining ADA

Mining ADA is even easier than mining a Proof of Work coin such as Ethereum, because there are no hardware requirements and no technical expertise is necessary (unless you want to run your own Cardano node to help promote the vision of “DeFi”, or decentralized finance). All in all, it took only me about 30 minutes to start mining.

The only requirement to mine ADA is to own some ADA in the first place. So, in the name of experimentation (and to experience the thrill of jumping on a bandwagon), I purchased some ADA on a cryptocurrency exchange (Coinbase). The market price of ADA at time of purchase was $1.77 USD per ADA.

It should be noted that crypto exchanges are not crypto wallets, and most people do not recommend holding your actual assets in the exchange itself, because exchanges are susceptible to hacks. On the other hand, a properly set-up wallet can be incredibly secure, such that nobody other than yourself can freeze, steal, seize, or otherwise obtain access to the assets in it (this is, of course, one of the arguments for cryptocurrency in general as an unassailable store of value; a fascinating topic for another time). Anyway, I created a separate ADA wallet. There are many choices for cryptocurrency wallets these days, but I went with Yoroi, one of the two official ADA wallets.

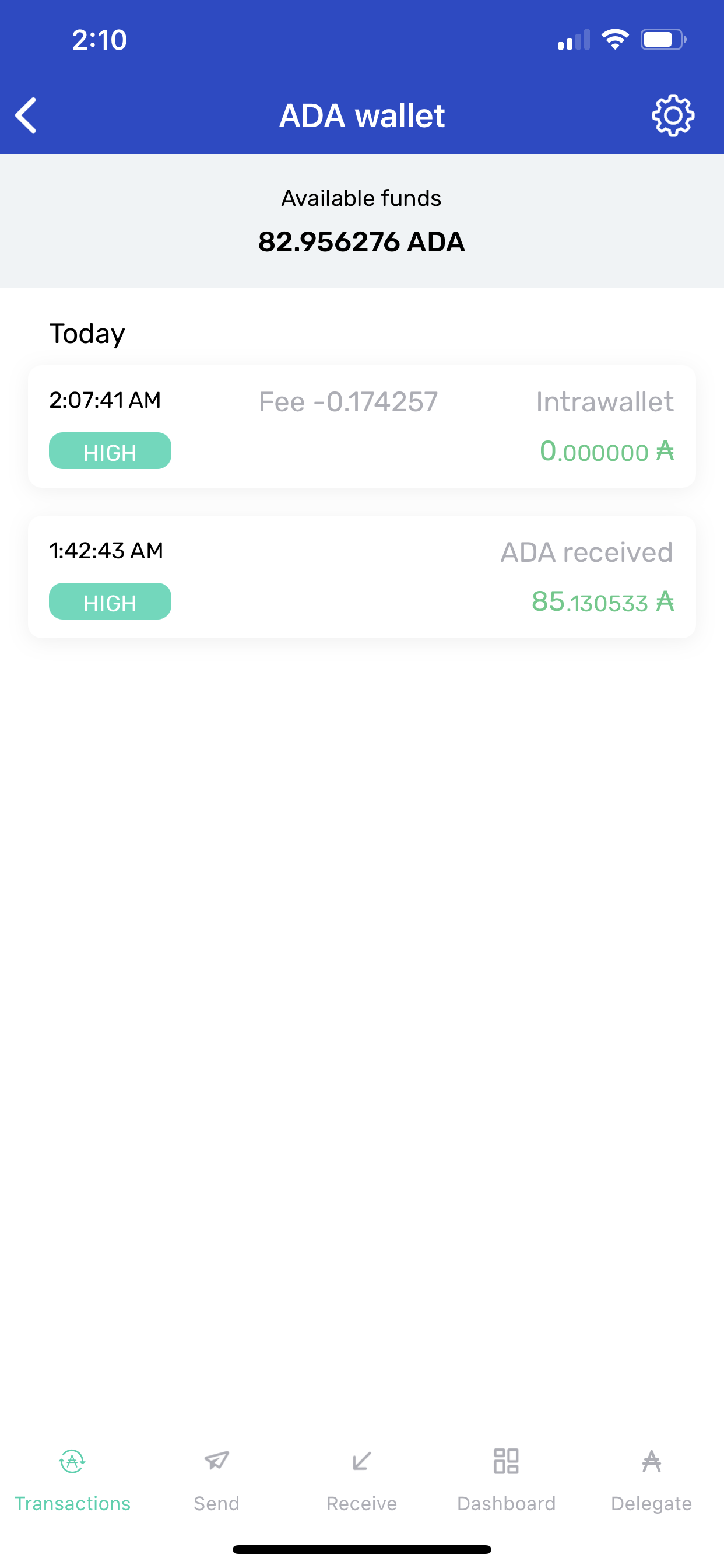

Next, I simply transferred my ADA coins that I just purchased from Coinbase to my ADA wallet. This transaction was completed and validated within a minute, a nice real-life demonstration of a blockchain network in action.

Sent 85 ADA from Coinbase at 1:42…

…received in Yoroi wallet within the same minute

From within Yoroi, the official wallet, staking is incredibly simple. The “Delegate” button takes me to the Staking Center, where I can pick one of hundreds of Cardano pools to delegate my ADA to:

ROA stands for “return on ADA”

The Cardano network runs on units of time of 5 days, known as Epochs

Cardano pools operate much like pools for any other cryptocurrency; in a pool a group of miners come together to combine their resources (computing power for Proof of Work cryptos, ADA coins for Cardano) to increase the chances of successfully validating a transaction and receiving a reward. Otherwise, individual miners may never see any rewards, due to the extremely low probability of any single miner submitting the correct proof. Interestingly, the Cardano network reduces rewards for pools which exceed a certain size to deter massive pools; this also has the effect of promoting a truly distributed network where no single entity has too much power.

I won’t discuss how to choose a pool here. Ultimately, any large (but not over-saturated) pool is likely to provide similar results. I just picked a pool with relatively low fees. Staking ADA does require a deposit of 2 ADA ($3.54 at time of staking) and a 0.17 ADA ($0.30) transaction fee. The 2 ADA deposit is returned when you choose to un-delegate your ADA. So of my 85 ADA, 82.9 ended up being staked.

When you delegate your ADA to a pool, it never leaves your ADA wallet. There is no risk of losing any ADA when you stake it for mining. It’s a good idea to keep an eye on your pool though, because if the pool goes offline you won’t receive any staking rewards.

Results

The Cardano network runs on units of time known as Epochs, and each Epoch is 5 days. It takes 3 to 4 Epochs (15 to 20 days) after you first stake your ADA for initial staking rewards to arrive. Subsequently, rewards are paid every Epoch, or every 5 days. There’s nothing to do in the meantime. It’s really is as passive as it gets.

I initiated staking on Epoch 269. On Epoch 273, I received the first staking rewards: 0.032483 ADA. Rewards will subsequently come in every 5 days. On the next Epoch (274), I received the next reward of 0.054401 ADA, bringing my total to 0.086844, etc.

Rewards after the first Epoch of reward eligibility (Epoch 273)

Rewards after 2 Epochs

Rewards after 3 Epochs

From this point onwards, the staked ADA will generate staking rewards every Epoch, or every 5 days. Also, ADA rewards are automatically “reinvested” for staking, which is reflected under the total amount of ADA delegated.

Risks

As I previously mentioned, the act of staking ADA does not entail any risk in and of itself. The main risk of mining a Proof of Stake coin like ADA, obviously, is that you have to buy into ADA in the first place. You must own ADA in order to stake it and earn returns on your ADA. Money doesn’t grow on trees, so purely from an investment standpoint, spending $X on ADA to mine ADA is the same as on spending $X on computer hardware to mine a Proof of Work coin. However, the difference is that the computer hardware has utility outside of crypto mining, and many people already own existing computers that can do Proof of Work. When I mined Ethereum, I used my computer that I already had since 2017, so psychologically, I wasn’t “spending” any additional money, and any coins I got were “free”. That’s not the case with ADA.

Nominally, the ROA, or “return on ADA”, of staking ADA is about 4.5% to 5% per year, varying slightly between different pools. Therefore, you can be assured that your ADA will grow by about this amount. However, the actual returns from buying and mining ADA depend heavily on the market price of ADA. This is no different from Ethereum or any other cryptocurrency, where the profitability of mining is dictated mostly by market price, rather than by mining yield. If the price of ADA tanks, then no amount of mining yield will make up for the losses on your initial investment.

In fact, this exact scenario happened in my experiment. As I revealed above, I bought 85 ADA for $150 at a price of $1.77 per ADA, including minor transaction fees. At time of this writing, the price of ADA has fallen to about $1.35. This means that although I earned 0.12 ADA from staking thus far (approximately 16 cents), the total value of my ADA has fallen to about $112. Of course, if the price of ADA recovers in the future, then mining ADA could end up being profitable. But as of right now, if I sold all of my ADA I would suffer a $38 loss.

Is ADA here to stay?

This is a difficult question to answer. The vast majority of cryptocurrencies are dead or abandoned. While cryptocurrency and decentralized finance, or “DeFi”, isn’t going anywhere, the world probably does not need thousands of different cryptocurrencies, many of which have been described as Ponzi or pump-and-dump schemes. I recently covered a cryptocurrency named TITAN which completely collapsed from $65 to $0 in one day.

As previously mentioned, ADA/Cardano is currently the 4th or 5th largest cryptocurrency by market cap overall, behind Bitcoin, Ethereum, Tether, and sometimes Binance Coin. It currently has a market cap of approximately $40 billion. It is also the largest Proof of Stake cryptocurrency by market cap. Cryptocurrency networks are increasingly moving away from Proof of Work to other consensus algorithm methods such as Proof of Stake. In fact, Ethereum, the second largest cryptocurrency, is moving to a Proof of Stake model and is in midst of a transition to Eth 2.0. When complete, the Ethereum’s blockchain will use Proof of Stake for consensus as well, and Ethereum mining with GPUs will be a thing of the past. Therefore, whatever happens to ADA itself, Proof of Stake cryptocurrencies are probably going to be around for awhile.

As always, cryptocurrencies are highly volatile, highly speculative, and highly risky assets. Their market prices generally fall outside the scope of traditional asset valuation methods. They may have little or no intrinsic value. The world of cryptocurrency is fascinating to learn about, but I am not recommending that anyone invest in any particular cryptocurrency. For more traditional investing articles, check out my Investing 101 series instead. Happy investing!

9/1/21 update: after several months of ADA staking, I have now earned about 1 ADA. I originally purchased ADA at a price of $1.77 USD per ADA. In the last 2 weeks of August, however, the price of ADA has spiked, and is now over $3 USD. This is thought to be in anticipation of an upcoming upgrade to the Cardano network, nicknamed Alonzo, scheduled for September 2021, which would allow for smart contracts. I will continue to watch both ADA as well as the overall cryptocurrency market with interest, and post updates from time to time.