Vanguard vs. Fidelity vs. Charles Schwab: Comparison of the most popular retail brokerages

Last updated 01/04/2022 with full 2021 returns. The views in this article are my opinion only. I do not endorse any product or service.

What is a brokerage?

A brokerage is an institution that offers broker services, much like a bank is an institution that offers banking services. If you want to write checks, you need a checking account. If you want to buy and sell stocks, ETFs, options, bonds, mutual funds, and index funds, you need a brokerage account.

When it comes to brokerages, we are a bit spoiled for choice. Much like banks, there are multiple brokerages out there vying for your business. And I should point out that many financial institutions offer both banking and brokerage services, so the distinction between a bank and brokerage can get a little blurry. For example, I use JP Morgan Chase as my bank (for no particular reason over any other national or regional bank). JP Morgan Chase also offers brokerage services. In fact, every month when I automatically transfer money from my Chase account into my brokerage account, Chase recognizes the transaction and puts a little message next to it telling me that I can also invest with Chase instead. It’s a bit annoying but I suppose they get an A for effort.

Why these three brokerages?

Simply put, these three brokerages (Vanguard, Fidelity, and Charles Schwab) not only offer traditional brokerage services, but they also offer a large selection of in-house mutual funds and index funds. Not all brokerages are created equal. While you can buy and sell stocks and ETFs with any brokerage, mutual funds are proprietary products. This applies to index funds too, as index funds are just a type of mutual fund. For example, if you want to buy the Vanguard Total Stock Market index fund (VTSAX) you need a Vanguard brokerage account. And if you want to buy Fidelity Contrafund (FCNTX) you need a Fidelity brokerage account. Technically, you can buy a Fidelity mutual fund from your Vanguard account and vice-versa, but if you do, you will pay an additional fee. Also, not all brokerages even support mutual funds or index funds. For example, Robinhood does not offer trading of bonds, mutual funds, or index funds. This likely reflects a different target audience and investing philosophy: Robinhood is designed for active day-trading, whereas Vanguard is designed more for long-term, passive investing. Finally, many Vanguard index funds are also offered in an ETF form, which means you can buy the ETF version from any brokerage. It’s all slightly more confusing than it needs to be.

Anyway, because these three brokerages offer not just brokerage services but also mutual funds and index funds, they are extremely popular. By the way, don’t fret about the proprietary nature of mutual funds. First, you can have multiple brokerage accounts just like you can have multiple bank accounts. Second, regardless of which brokerage you choose, chances are they will offer a fund that is similar, if not identical, to a fund at a rival brokerage. And when it comes to index funds, there’s virtually no difference. A Schwab S&P 500 index fund is, for all intents and purposes, identical to a Vanguard or Fidelity S&P 500 index fund. With rare exceptions, you can create an identical portfolio at any of these brokerages. Third, you could just buy the Vanguard ETF version of its index funds, rendering all of these points moot. The following table shows a comparison of some “equivalent” index fund offerings from each brokerage:

| Comparison of "equivalent" Vanguard, Fidelity, and Schwab index funds | ||||||

| Total U.S. Stock Market | ||||||

| Name | Ticker | Expense ratio | 2021 | 3 Year | 5 Year | 10 Year |

| Vanguard Total Stock Market Index Admiral | VTSAX | 0.04 | 25.71% | 25.77% | 17.98% | 16.29% |

| Fidelity Total Market Index Fund | FSKAX | 0.015 | 25.65% | 25.72% | 17.93% | 16.25% |

| Schwab Total Stock Stock Market Index | SWTSX | 0.03 | 26.40% | 26.88% | 17.82% | 16.09% |

| S&P 500 | ||||||

| Name | Ticker | Expense ratio | 2021 | 3 Year | 5 Year | 10 Year |

| Vanguard 500 Index Admiral | VFIAX | 0.04 | 28.66% | 26.03% | 18.43% | 16.51% |

| Fidelity 500 Index | FXAIX | 0.015 | 28.69% | 26.06% | 18.46% | 16.54% |

| Schwab S&P 500 Index | SWPPX | 0.02 | 29.49% | 27.30% | 18.39% | 16.37% |

| Total U.S. Bond Market | ||||||

| Name | Ticker | Expense ratio | 2021 | 3 Year | 5 Year | 10 Year |

| Vanguard Total Bond Market Index Admiral | VBTLX | 0.05 | -1.67% | 4.82% | 3.58% | 2.86% |

| Fidelity US Bond Index | FXNAX | 0.025 | -1.79% | 4.72% | 3.52% | 2.86% |

| Schwab US Aggregate Bond Index | SWAGX | 0.04 | -2.49% | 4.17% | N/A* | N/A* |

| Total International Stock Market | ||||||

| Name | Ticker | Expense ratio | 2021 | 3 Year | 5 Year | 10 Year |

| Vanguard Total Intl Stock Index Admiral | VTIAX | 0.11 | 8.62% | 13.67% | 9.90% | 7.68% |

| Fidelity Total International Index | FTIHX | 0.06 | 8.47% | 13.54% | 9.85% | N/A** |

| Schwab International Index | SWISX | 0.06 | 11.58% | 14.20% | 9.68% | 7.79% |

| Yields are as of 12/31/2021. * No data, fund inception in 2018; ** No data, fund inception in 2017 | ||||||

As you can see, while index funds between the institutions are not completely identical, they are similar enough as to make no real difference to most investors. It is difficult to draw any real conclusions about which institution offers the “best” index funds.

For example, Schwab’s S&P 500 index fund returned 29.49% in 2021. This is rather remarkable, because the S&P 500 itself only returned 28.71% (with dividend reinvestment). Both Fidelity and Vanguard’s S&P 500 index fund followed the S&P 500 more closely, at 28.69% and 28.66%, respectively. The extent to which an index fund’s returns deviates from the index itself is known as tracking error, and all funds have some degree of tracking error. In some years, the tracking error will work in your favor, and in other years, it will not. Although the Schwab S&P 500 fund outperformed its two competitors in 2021, a look back at 5 and 10 year returns shows that it in fact trails the other two funds slightly.

While all S&P 500 index funds track the S&P 500, when it comes to international funds and bond funds, you’re more likely to see slight performance differences. This is because although the funds have similar names, they don’t necessarily track the same index. For example, Vanguard’s Total International Stock Index Fund tracks the FTSE Global All Cap ex US index, whereas the Fidelity Total International Index fund tracks the MSCI ACWI ex USA Investable Market index, and the Schwab International Index tracks the MSCI EAFE Index. What’s the difference? The MSCI EAFE Index does not include Canada, nor developing countries such as China and many African markets. So the Schwab International Index fund is not a “total” international index fund, unlike the Vanguard or Fidelity versions.

Again, I think its not entirely fruitful to try and split hairs with otherwise equivalent index funds. Paralysis by analysis doesn’t help the investor in this case! With that said, there are some other minor differences between these industry heavyweights. Let’s take a look:

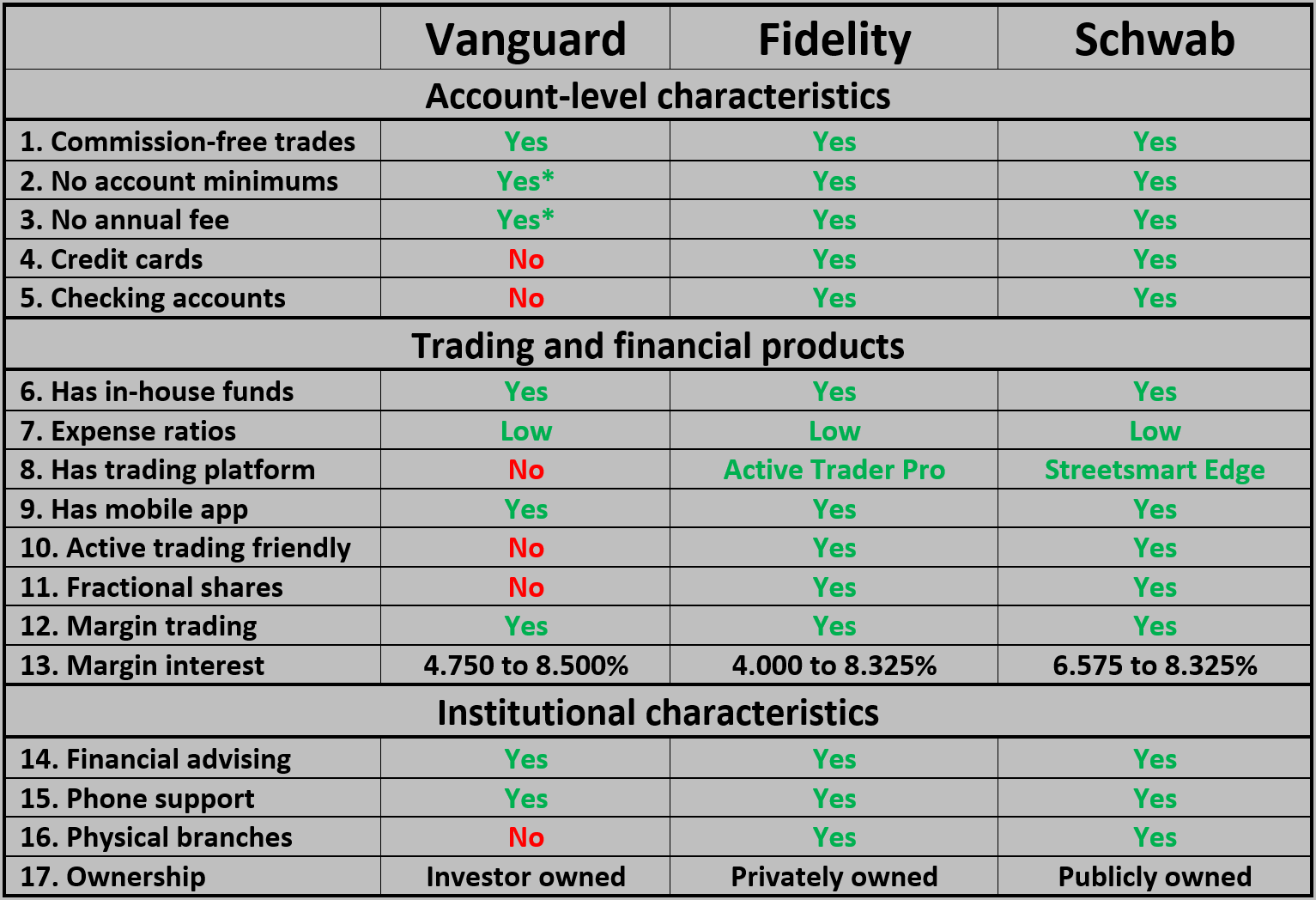

Disclaimer: Brokerage and account terms and conditions are subject to change at any time! Do not rely on this table or any information on this website. Always read the latest terms and conditions from the brokerage itself!

Explanation

Commission-free trades. All three brokerages offer commission-free trades on stocks, bonds, and in-house mutual funds. All three brokerages do charge commissions on some trades, such as options contracts or mutual funds from other institutions.

No account minimums. No minimum account balance is required at any of these brokerages. Many Vanguard index funds, however, do have minimum investment requirements.

No annual fee. Vanguard does charge a $20 annual account service fee, but this is waived if you opt to receive account statements electronically.

Credit cards. Fidelity and Charles Schwab offer credit cards. The Fidelity Rewards Visa Signature Card offers 2% cash back on all purchases and is one of the best cash-back credit cards available anywhere. The Schwab Investor Card from American Express offers 1.5% cash back.

Checking accounts. Fidelity and Charles Schwab also offer some banking and cash management services, including checking accounts.

Has in-house funds. All three brokerages offer a selection of in-house mutual funds and index funds.

Expense ratios. All three brokerages offer low expense ratios for their index funds. Fidelity even offers a few zero cost funds, although across the industry, index fund expense ratios are now so low that they’re mostly negligible.

Has trading platform. Vanguard does not offer a software trading platform. Trades can be made via mobile app or web interface. Fidelity and Charles Schwab do offer software trading platforms: Active Trader Pro and Streetsmart Edge, respectively.

Has mobile app. All three brokerages offer a fully functional mobile app.

Active trading friendly. While it is certainly possible to place trades with Vanguard (it is a brokerage, after all), their website and mobile app are not really designed for active trading. In fact, Vanguard’s philosophy and user-interface appears to discourage any active trading.

Fractional shares. Fractional shares refer to the ability to purchase less than 1 whole share of a stock or ETF. For example, if you have $25 and a share of a stock costs $100, you cannot purchase it unless your brokerage allows fractional shares, in which case you can purchase 1/4 of a share. Mutual funds do not have this limitation. Vanguard does not support fractional shares; both Fidelity and Charles Schwab do with some limitations.

Margin trading. All three brokerages offer margin trading, which is the ability to trade with borrowed money from the brokerage.

Margin interest. Interest rates charged by each brokerage for margin borrowing, which varies based on the amount borrowed, among other factors.

Financial advising. Although all three brokerages make it very easy for anyone to invest, they do also offer in-house financial advising for an additional fee. Vanguard Personal Advisor Services charges an annual fee (up to 0.30%) with $50,000 minimum investment. Fidelity has two tiers of wealth management services, both with minimum investment and annual fees. Schwab offers a number of investment advising tiers with different fee structures. All three institutions are very upfront about their financial advisory fees. For more on this topic, read my article about whether you need a financial advisor.

Phone support. All three brokerages offer phone customer support. Only Charles Schwab offers 24/7 phone support, however.

Physical branches. Vanguard does not have any physical branches. Both Fidelity and Charles Schwab offer physical branches across the United States.

Ownership. Finally, we come to perhaps the biggest yet least visible difference between the three brokerages. The ownership structure of these institutions is fundamentally different.

Vanguard Group has a unique ownership structure in that it is investor-owned. Therefore, investors in Vanguard funds are also owners of Vanguard, and Vanguard has no external ownership. The goal of Vanguard Group, as envisioned by John Bogle, is not to make profit from investors (as this wouldn’t make sense), but rather to return value to investors by lowering fees as much as possible. Vanguard was the first to introduce low cost index funds to the masses, and Vanguard led the industry in progressively lowering index and mutual fund fees over the years. Some people believe that Vanguard’s ownership structure also helps prevent conflicts of interest as Vanguard can cater to its customers and shareholders simultaneously, since they are one and the same. For all of these reasons and more, Vanguard funds remain some of the most popular in the world. Vanguard may not have the bells and whistles of other brokerages, but the average Vanguard investor doesn’t care for these distractions.

Fidelity Investments is a privately owned company, with the majority of ownership stake held by the Johnson family. The rest of Fidelity’s ownership stake is held by private investors, mostly current and former employees of the company. As with any for-profit company, Fidelity’s mission is to maximize profits for its owners and shareholders. It can only do so by offering compelling financial products and services to customers. For example, Fidelity even offers zero-cost index funds, something that no other brokerage offers. Many Fidelity funds now have lower expense ratios than equivalent Vanguard funds, although Fidelity lowers its fees out of competitive pressure rather than desire to benefit customers per se.

Charles Schwab Corporation is a publicly-traded company under the ticker SCHW. As with Fidelity, Schwab is a for-profit company and its mission is to maximize profits for its shareholders. The difference between Schwab and Fidelity is that anyone can become a shareholder of Schwab by buying shares of Schwab stock. Charles Schwab also offers compelling products and services, including some index funds with lower fees than Vanguard. Again, this is likely not a result of altruism, but competitive necessity.

Which brokerage(s) does the Frugal Doctor use?

I personally use both Vanguard and Fidelity. When I first started investing, I opened a Vanguard brokerage account because I first heard about index funds in the context of Vanguard and John Bogle. Vanguard was also offering the lowest expense ratios in the industry at the time. I still make monthly contributions to my Vanguard account to this day. In 2016, I opened a Fidelity account as well because my current employer’s 401(k) plan is managed through Fidelity, and I found it convenient to have both my brokerage accounts and retirement accounts in one location. I now use Fidelity as my primary brokerage. Currently, around 20% of my investments are through Vanguard and 80% through Fidelity. I also do all of my active trading through Fidelity. If you’re interested in my actual asset allocation and funds, you can find that information at the end of my 2021 in review article.

In my opinion, the choice of brokerage matters very little in the long run. If you are training for a marathon, you need to put on a pair of shoes and start running. The brand of your shoes is irrelevant. The same principles apply to investing: time and discipline are more important than anything else. Happy investing!